As invoice volumes grow, payment runs start taking more time than they should. AP teams spend hours sending ACHs or checks, tracking down payment details, and reconciling everything back to the ERP. With more steps comes more room for errors, and more chances for fraudulent or incorrect payments to slip through.

B2B payment automation providers solve these issues by taking over the most manual parts of the payment process.

They handle vendor onboarding, send payments through preferred methods, match payments to invoices automatically, and add built-in controls to keep your process secure.

However, with countless providers in the market, choosing the right one isn't straightforward.

This guide compares the best B2B payment automation providers, breaking down their key features and use cases to help you choose a platform that fits your company’s needs.

These are:

- Rillion – Secure, automated payments that move faster (and pay you back)

- Coupa – Total spend management with comprehensive risk monitoring

- BILL – Financial operations platform for invoices and automated billing

- SAP Concur – Complete payment visibility from invoice to settlement

- Tipalti – Finance automation for mass payments across 200+ countries

- Sage Intacct – Financial management with dimensional analytics

- Stampli – Procure-to-pay automation with collaborative invoice management

- Medius – Complete source-to-pay automation for global enterprises

8 best B2B payment automation providers at a glance

Here’s a look at the best B2B payment automation providers, including who they’re designed for and their standout features:

| B2B payment automation providers | Best for |

Standout feature |

|

1. Rillion – Secure, automated payments that move faster (and pay you back) |

|

Multi-entity payment management makes it effortless to manage payments across locations. |

| 2. Coupa – Total spend management with comprehensive risk monitoring |

|

Risk monitoring capabilities that flag suspicious activities in real-time to reduce risk of fraud. |

| 3. BILL – Financial operations platform for invoices and automated billing |

|

Extensive network that facilitates fast and secure payments to over 5 million vendors. |

| 4. SAP Concur – Complete payment visibility from invoice to settlement |

|

Native integration with SAP lets businesses manage their entire spending lifecycle in one place. |

| 5. Tipalti – Finance automation for mass payments across 200+ countries |

|

Self-service portal helps streamline vendor onboarding. |

| 6. Sage Intacct – Financial management with dimensional analytics |

|

Finance Intelligent Agent that automates routine tasks and surfaces actionable insights. |

| 7. Stampli – Procure-to-pay automation with collaborative invoice management |

|

In-app messaging capabilities facilitate collaboration between AP teams and vendors. |

| 8. Medius – Complete source-to-pay automation for global enterprises |

|

Prepayment capabilities for companies to collect advance payments before delivering goods. |

Here’s a full breakdown of the best B2B payment automation providers, starting with our top pick.

1. Rillion – Secure, automated payments that move faster (and pay you back)

Rillion is a payment automation platform that makes it easy for businesses to pay vendors securely, accurately, and on time.

With Rillion Pay, companies can replace manual check runs with secure virtual card payments, automated ACH transfers, and built-in reconciliation from one platform.

Payments are faster, safer, and even generate rebates, turning accounts payable into a source of savings.

What’s more, Rillion doubles as an AI-powered AP automation software. That combination means Rillion automates every step from invoice approval to payment, giving finance teams complete visibility and control over cash flow across all entities.

AI captures and codes invoices with exceptional accuracy, routes them through smart approval workflows, and ensures every invoice is paid correctly. It saves your finance team hours while minimizing manual follow-up and reducing the potential for errors that typically slow them down.

Key features in Rillion’s B2B payment automation software, enhanced by AI, include:

- Automated vendor payments: Pay suppliers securely through virtual cards, ACH, or domestic and international bank transfers from one centralized platform. Reduce manual work and payment errors while gaining real-time visibility into payment status and cash flow.

- Virtual card payments with rebates: Generate rebates on every eligible transaction. Rillion Pay turns your accounts payable process into a revenue opportunity while minimizing fraud risk.

- Payment reconciliation: Automatically match payments to invoices for error-free reconciliation and accurate financial reporting. No more time-consuming manual checks or mismatched records.

- Payments as a Service: Rillion manages supplier onboarding, payment preferences, and exception handling for you, ensuring every vendor is paid the right way, every time.

- AI-powered invoice capture and coding: Rillion’s built-in AI reads invoice data across formats with around 90% accuracy, predicts general ledger codes, and learns from past behavior to get smarter over time.

- Approval workflows: Automate approval routing with customizable rules or AI-driven suggestions. Approvers receive reminders automatically, keeping approvals moving fast and on schedule.

- 3-way purchase order matching: Improve accuracy and compliance with automated 2- or 3-way PO matching, ensuring invoices are only paid when matched to approved POs and receipts.

- Multi-entity management: Manage payments and invoices across multiple entities or locations from one dashboard. Get a consolidated view of company-wide spend while keeping local control and flexibility.

- ERP integrations: Rillion connects seamlessly with 50+ leading ERPs, syncing invoices, approvals, and payments directly into your financial system for a fully automated AP-to-payment workflow.

- Riley, your AI Assistant: Ask questions about payments, suppliers, or invoice status and get instant answers without switching screens.

Rillion’s standout feature – Multi-entity payment management

Rillion makes it effortless to manage and automate B2B payments across multiple entities, business units, or locations.

Every entity can maintain its own chart of accounts, approval rules, and ERP connection, while finance leaders gain a unified view of cash flow and liabilities across the organization.

Instead of juggling separate bank accounts or logging into multiple systems, you can schedule, approve, and track vendor payments for every subsidiary in one place. Each payment is automatically coded to the right entity and reconciled against the correct invoices so that there are no manual steps and no double entries.

Who is Rillion built for?

Rillion is built for mid-market companies that process a high volume of vendor payments, typically 24,000 invoices or more per year, and want to eliminate manual payment runs while gaining better control over cash flow.

It’s especially valuable for organizations with multiple entities or subsidiaries, where managing separate payment workflows often leads to errors, delays, and visibility gaps.

Rillion is trusted across industries like healthcare, manufacturing, and hospitality, where secure, on-time payments and accurate reconciliation are business-critical.

Rillion is for finance leaders who want to:

- Make payment runs faster without increasing finance team headcount.

- Replace checks with secure virtual card and ACH payments while earning rebates on every eligible transaction.

- Gain centralized visibility into all outgoing payments across entities.

- Reduce fraud risk and prevent payment errors with built-in compliance and audit trails.

- Eliminate manual reconciliation and double entry through seamless ERP integrations.

- Empower AP teams with intuitive, easy-to-use automation software that scales.

- Work with a trusted partner to implement AI across their finance processes, confidently and securely.

During such rapid growth of our business, we have had several ongoing projects at the same time. Therefore, it’s been crucially important that, in addition to invoice processing, we are also able to implement purchases through Rillion’s system.

Read about how Renta Group used Rillion’s purchase-to-pay automation to streamline approvals, speed up vendor payments, and gain real-time visibility across all entities, supporting rapid growth without adding AP headcount.

2. Coupa – Total spend management with comprehensive risk monitoring

Coupa offers a B2B payments product called Coupa Pay, which lets businesses manage spend and payments to their suppliers in one location. It supports ACH, digital checks, and digital wallets so vendors can receive payments in their preferred method.

The risk of fraud is always top of mind for many companies. Coupa’s B2B payment solution features AI-powered fraud detection software that flags suspicious activities before they can lead to financial losses. Businesses can connect Coupa Pay to its invoicing solution to streamline their procure-to-pay processes.

Key features in Coupa‘s B2B payment automation software include:

- Virtual cards: Lets companies pay vendors faster and gain more control of their spend, while reducing the risks of physical cards.

- Supplier self-service portal: Provides a centralized location where companies can speed up supplier onboarding and vendors can send updates.

- Automated reconciliation: Connecting Coupa Pay to its invoicing solution provides businesses with automatic reconciliation.

Users find Coupa easy to use for managing invoicing and procurement. However, one user noted that global deployments were too complex, suggesting that setting up the solution may require more resources for companies with complex global operations.

Coupa’s standout feature – Risk monitoring

One feature that makes Coupa’s payment management software stand out is its risk monitoring capabilities. AI-powered tools like SpendGuard detect and flag risk across payments in real-time. The system also continuously monitors external data, so businesses can take proactive measures against high-risk suppliers and protect their supply chain.

Who is Coupa built for?

Coupa’s B2B payments automation solution is ideal for mid-sized to enterprise organizations that already use or are considering its suite of spend management tools. Companies can use the platform to manage spend and payments to vendors in one place.

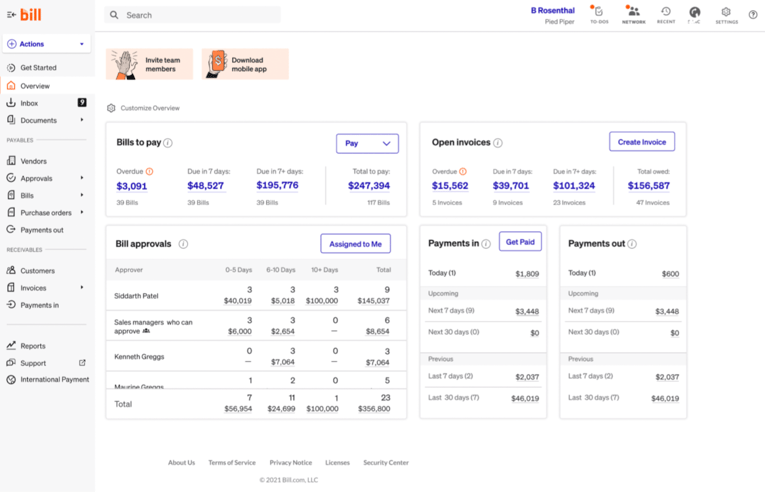

3. BILL – Financial operations platform for invoices and automated billing

BILL, formerly Bill.com, is a financial operations platform that allows businesses to send invoices, manage expenses, and automate billing in one place.

With BILL, companies can streamline their accounts payable and speed up payments to vendors. It supports payment methods, such as ACH, virtual card, and international wire transfers, so you can meet your customers’ needs. An online payment portal lets you easily track which invoices have been paid and which ones are still pending.

Key features in BILL‘s B2B payment automation software include:

- Automated workflows: Customizable workflows and role-based permissions ensure approvals get to the right people.

- Integrations: Allows you to sync payments with your accounting software to reduce manual data entry and automate reconciliation.

- Mobile access: iOS and Android apps enable you to manage and track payables from anywhere on the go.

Users like that the platform gives them visibility and control over their spending, also citing that it makes reconciliation faster. However, one user notes that approval processes for reimbursements can feel clunky when multiple approvers are involved.

BILL’s standout feature – Extensive vendor network

One feature that makes BILL stand out is its network of over 5 million vendors, which enables fast and secure payments. If your vendor is in the network, connect with them to initiate ACH or virtual card payments. If a vendor isn’t in the network, you can send them an invite to join and make future payments easier.

Who is BILL built for?

BILL’s B2B payment automation solution is best for small to mid-sized businesses looking to modernize their payment processes without requiring extensive resources to implement. It’s also ideal for companies with moderate payment volumes that need strong accounting software integration with tools like QuickBooks.

4. SAP Concur – Complete payment visibility from invoice to settlement

SAP Concur is a cloud-based spend management platform that enables businesses to automate expense reporting and invoice processing. Invoice Payment Manager, its B2B payment product, removes the manual work associated with paying vendor invoices.

Companies can automate B2B payments directly within the platform, while maintaining full visibility and control over their payment workflows. They can also configure it to schedule batch payments and optimize cash flow timing. What’s more, Invoice Payment Manager supports virtual cards, electronic funds transfer (EFT), ACH, and even Single Euro Payments Area (SEPA) for payments to European countries.

Key features in SAP Concur‘s B2B payment automation software include:

- Virtual cards: Generate single-use virtual card numbers to make secure vendor payments and reduce the risk of fraud.

- Expense reimbursements: Automated workflows ensure employees are quickly reimbursed for business expenses.

- End-to-end payment system: Provides visibility into each step of the payment journey, so finance teams can keep payments on track.

Overall, SAP Concur has fairly positive reviews. Users like that the platform simplifies expense management and provides visibility into their spending. However, some users note that the platform isn’t as intuitive as modern software.

SAP Concur’s standout feature – Native integration with SAP

Companies that already use SAP can add Invoice Payment Manager to enable B2B payment automation. They can manage their entire spending lifecycle without having to maintain separate payment platforms.

Who is SAP Concur built for?

SAP Concur is a good fit for mid-sized to enterprise organizations, particularly those in SAP’s ecosystem. It’s also ideal for companies that need to manage their travel, expense, and invoice management processes in one place.

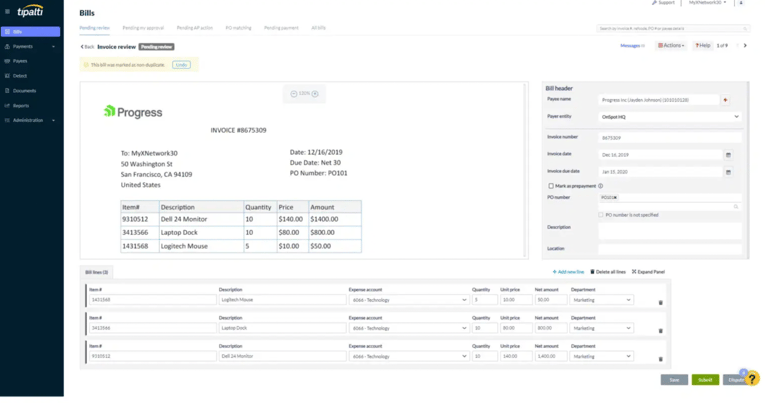

5. Tipalti – Finance automation for mass payments across 200+ countries

Tipalti is a finance automation solution designed to help businesses scale their accounts payable. It offers an automated B2B payments solution that can execute payments to over 200 countries in 120 local currencies via methods like ACH, wire transfer, PayPal, and more.

Tipalti’s payment solution also features built-in risk protections to flag suspicious activities, automated workflows to reduce manual work, and a portal to streamline onboarding.

Key features in Tipalti‘s B2B payment automation software include:

- Built-in tax compliance: Supports W-8 and W-9 collection, 1099 reporting, and international tax requirements to reduce compliance risks.

- Multi-currency support: Processes payments in over 120 local currencies using over 50 payment methods including local bank transfers and global ACH.

- Financial controls: Allows you to configure workflows and establish role-based access to protect payments.

Users love that with Tipaliti, they don't have to call to verify bank details because vendors enter their own details. However, some struggle with the system's OCR being unreliable in scanning VAT.

Tipalti’s standout feature – Self-service onboarding

Tipalti offers a branded payee portal that helps companies streamline vendor onboarding and strengthen relationships. Vendors can access the portal to track their payouts, choose their preferred payment method, and provide updates. It also monitors various data points to identify potential fraud in your network.

Who is Tipalti built for?

Tipalti is ideal for mid-sized to enterprise companies with high invoicing volumes to suppliers, contractors, or partners across multiple countries.

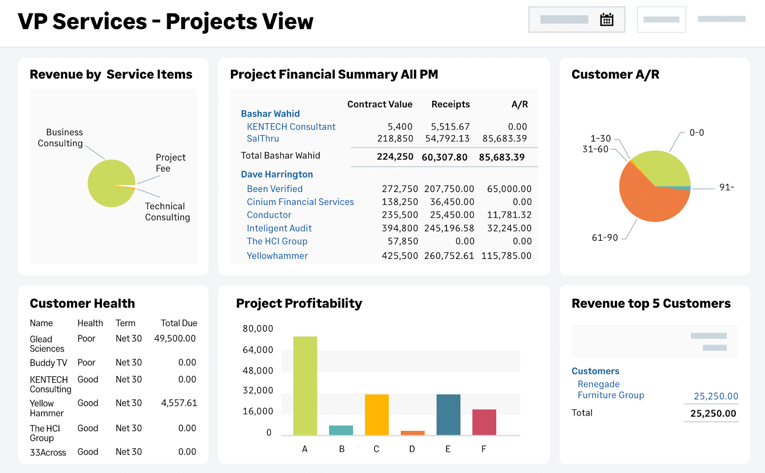

6. Sage Intacct – Financial management with dimensional analytics

Sage Intacct is a financial management platform that helps growing businesses automate their procure-to-pay processes. It’s compatible with popular payment solutions, such as Stripe and PayPal, that you can use to securely and quickly pay vendors.

The platform provides full visibility into payment status, so you can track payments throughout their lifecycle. It also offers reconciliation software with features like automated bank statement matching to speed up reconciliations.

Key features in Sage Intacct‘s B2B payment automation software include:

- Virtual card: Allows you to issue one-time virtual cards to reduce the risk of fraud and even potentially earn cash rebates.

- Bank reconciliation: Automatically matches payments with bank transactions to keep books up to date and reduce manual work.

- Financial reporting: Dashboards provide real-time payment insights with “dimensional” reporting that lets businesses dig deep into spending patterns.

Users find the automation features in Sage Intacct helpful in reducing manual work for recurring tasks like invoicing. However, some users note the platform has a steep learning curve and that some of the modules can feel “too segmented” and difficult to navigate.

Sage Intacct’s standout feature – Finance Intelligent Agent

One standout feature from Sage Intacct is its AI-powered Finance Intelligence Agent, which is embedded directly into the platform. Finance teams can use the agent to automate routine tasks, ask questions in natural language, and surface insights across all financial data.

Who is Sage Intacct built for?

Sage Intacct is a good fit for growing medium-sized businesses looking to digitize their payable and receivable workflows. It’s also well-suited for global organizations as they can use the platform’s multi-entity management features to centralize their financial operations.

Related read: 12 best Sage Intacct alternatives for AP automation in 2026

7. Stampli – Procure-to-pay automation with collaborative invoice management

Stampli provides businesses with the tools they need to make their procure-to-pay processes less painful. It sits on top of your ERP system to centralize invoice processing and automate approvals.

Stampli Direct Pay supports a range of payment options, including ACH, credit cards, and international wire transfers to pay vendors across over 100 countries. Configurable payment workflows reduce manual work and ensure invoices reach the right people.

Key features in Stampli‘s B2B payment automation software include:

- Vendor management: Lets businesses collect and manage vendor details in one place, including their preferred payment method.

- Audit trails: The platform maintains comprehensive audit trails to ensure transparency and compliance.

- ERP integrations: Integrates with popular ERP solutions, such as Sage, SAP, and QuickBooks to maintain a “single source of truth” for your data.

Many users note that Stampli is simple and easy to use when it comes to locating invoices

and knowing when payments are due. However, one drawback is the mobile app which some users say has limited functionality compared to the desktop version.

Stampli’s standout feature – Collaborative layer

Stampli features in-app messaging capabilities that allows AP teams to collaborate and communicate directly with vendors. Each invoice becomes a “hub” where teams can view full conversation histories and avoid miscommunications. Everything is fully auditable for compliance.

Who is Stampli built for?

Stampli works well for small to mid-sized businesses that are outgrowing basic AP tools. With its in-app messaging features. It’s also ideal for companies with invoice approvals that involve multiple stakeholders across different departments.

8. Medius – Complete source-to-pay automation for global enterprises

Medius is an AP automation solution that streamlines accounts payable processes, reduces manual data entry, and speeds up invoicing.

It offers a B2B payments automation module that supports various methods for domestic and international payments. These include ACH, check, wire transfers, SEPA, and more. Real-time visibility into payment statuses give businesses complete control over cash flow.

Key features in Medius‘s B2B payment automation software include:

- Risk factor alerts: Helps reduce the risk of fraud by highlighting suspicious items and making it easier to cross-check invoice details.

- Self-service portal: Allows companies to quickly onboard new suppliers and even create custom onboarding processes to meet unique requirements.

- Integrations: Offers fully managed integrations to popular ERP solutions, such as Microsoft Dynamics, Oracle NetSuite, and Oracle Fusion.

Users find Medius particularly useful in automating tedious AP tasks and gaining visibility into spending. However, some found the custom approval reminders feature could be improved.

Medius’s standout feature – Advance payments

One feature that Medius offers that some B2B payment automation platforms don’t is the ability to use prepayments to secure funds before delivering goods or services. Businesses can use this feature to cover production costs and improve their cash flow. They can also use it to reconcile down payments ahead of due dates and ensure accurate accounting.

Who is Medius built for?

Medius is built for large enterprises with complex AP processes and high transaction volumes across multiple entities or countries. It’s also ideal for companies looking for solutions to unify their source-to-pay lifecycle, increase spend visibility, and improve fraud prevention.

How to choose the best B2B payment automation provider for your company

Not all B2B AP payment automation providers are created equal. Choosing one with the right features can mean the difference between streamlined operations or payment chaos.

Look for these essential features to narrow down your choices:

- Scalability: Pick a provider that can keep up as the company grows. It should handle growing invoice volumes without the extra AP headcount.

- Payment methods: Find a solution that supports payment types, such as ACH, wire transfers, and virtual cards, so vendors can get paid in their preferred method.

- Automated payment reconciliation: Choose a B2B payment provider that can match payments with invoices automatically to reduce manual work.

- Integrations: Make sure the platform integrates with your existing ERP and banking systems. That way you won’t inadvertently create data silos.

- Security and fraud prevention: Look for B2B payment platforms that offer robust fraud detection that can catch suspicious activities before it becomes a problem.

- AI-enabled automation: Choose a solution that safely uses AI to improve data accuracy, suggest coding, route approvals intelligently, and surface potential risks before they impact cash flow.

While this list pulls together the best, which one is best for you will depend on your priorities, business size, and industry.

If you’re a mid-market company looking to streamline vendor payments, then Rillion is a great choice. It offers flexible payment options and features like automated payment reconciliation to AP teams to focus on more impactful work. Fraud detection and recovery controls protect payments from potential threats.

Schedule a demo of Rillion today to start automating vendor payments and cut down on manual work associated with manual invoicing.